The fresh inclusion away from timestamps raises the tamper-apparent character of one’s blockchain. One attempt to personalize otherwise change the investigation inside a cut off create result in a great mismatch between the timestamp plus the real period of the tampering, instantly appearing the clear presence of unauthorized changes. So it chronological company and you may tamper-apparent function subscribe the overall shelter and you may integrity of the blockchain system.

Hyperliquid dex – Kind of Decentralized Exchanges

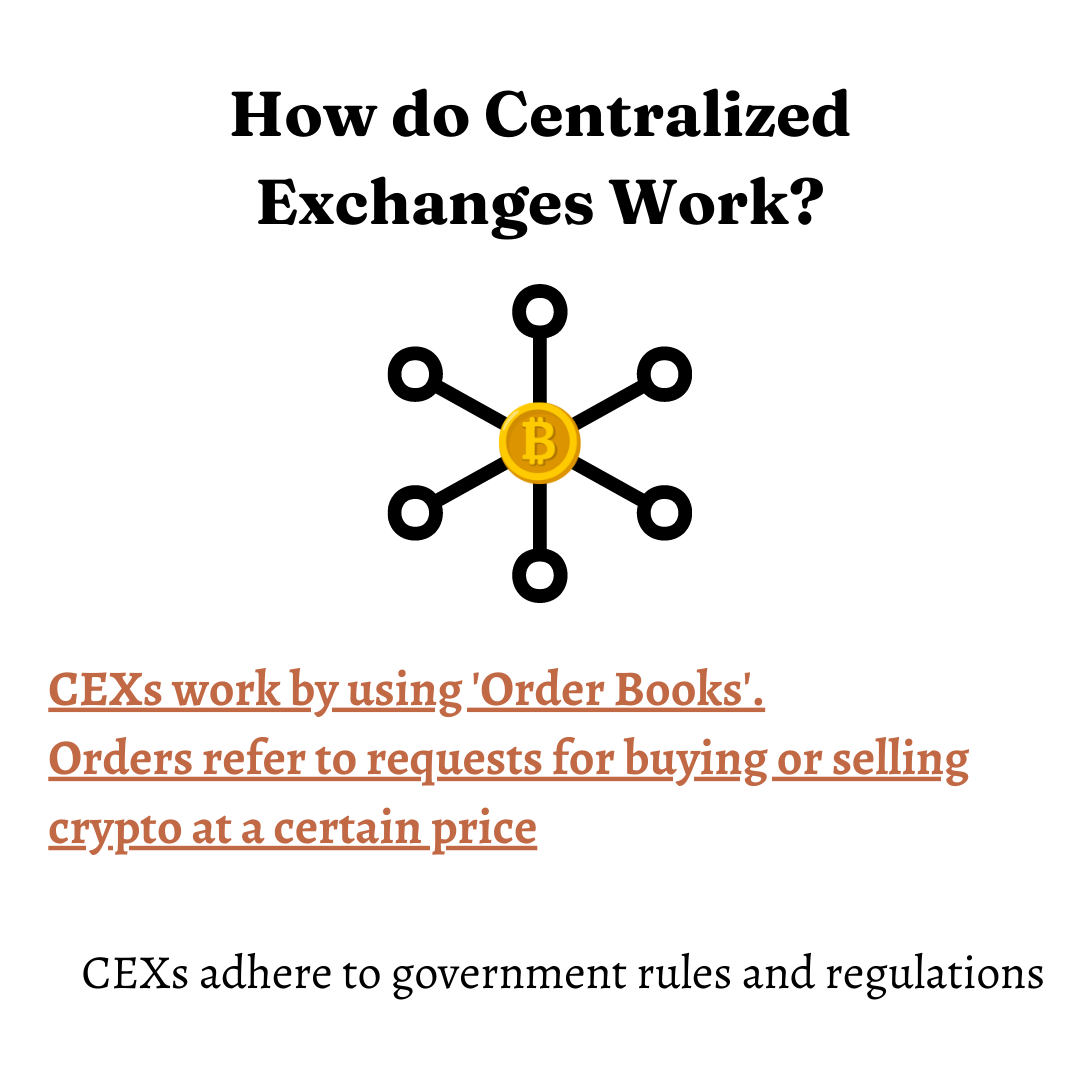

That it does away with need for centralized expert and creates an excellent trustless trade ecosystem. The newest CEX against DEX debate comes down to control, comfort, and you may defense. Extremely centralized exchanges render higher exchangeability, customer care services, and easy entry to change sets, which makes them a powerful selection for crypto buyers who require a good effortless feel.

The fresh blockchain network executes a reward-centered take off development techniques also known as “cut off mining” (Wang et al., 2019b). Within the blockchain tech, nodes that have bookkeeping benefits must are an excellent timestamp in the the brand new header of the newest study stop. That it timestamp means the actual time if block is actually composed or placed into the brand new blockchain.

- Instead of having fun with antique order complimentary, Automated Field Manufacturers (AMMs) utilize pre-financed exchangeability pools where pages can also be earn purchase costs.

- The ActiveTrader user interface try a deck customized and designed for people featuring numerous acquisition models, complex charting products, and you can large rate able to carrying out deals in the microseconds.

- Other area of the trade-out of anywhere between DEXs and you will CEXs boils down to if pages do as an alternative hold their crypto myself otherwise trust it on the exchange.

Decentralized Crypto Exchange List – Best DEXs by Group

Thus a great decentralized independent company (DAO) makes it possible for token holders to vote to your very important protocol conclusion such as finance allowance and you may method improvement. Revealed inside September 2020, ‘s the very first and you can hitherto prominent crypto DEX hyperliquid dex process constructed on . The widely used AMM-powered DEX facilitates token transfers, staking, and you will produce agriculture. In return for staking tokens inside the process liquidity swimming pools, profiles discovered LP tokens they can ranch to earn benefits in the form of the working platform’s local electricity and governance token, Cake.

Uniswap to possess token exchanges around the chains, dYdX for decentralized types having strong liquidity. Locating the best futures change DEX shouldn’t getting an issue for your requirements once reading this. When you are centralized futures exchange can be convenient, it offers reduced independence. It could be equally high-risk for individuals who look at the question of traders who missing vast amounts on the FTX replace failure. Yet not all of the tokens may be on a specific futures exchange DEX, you can keep pivoting if you don’t see an excellent DEX you to’s the greatest complement your. WooFi are an onchain futures trading platform having a simple yet effective order book and several choices for you to trading futures while the you like.

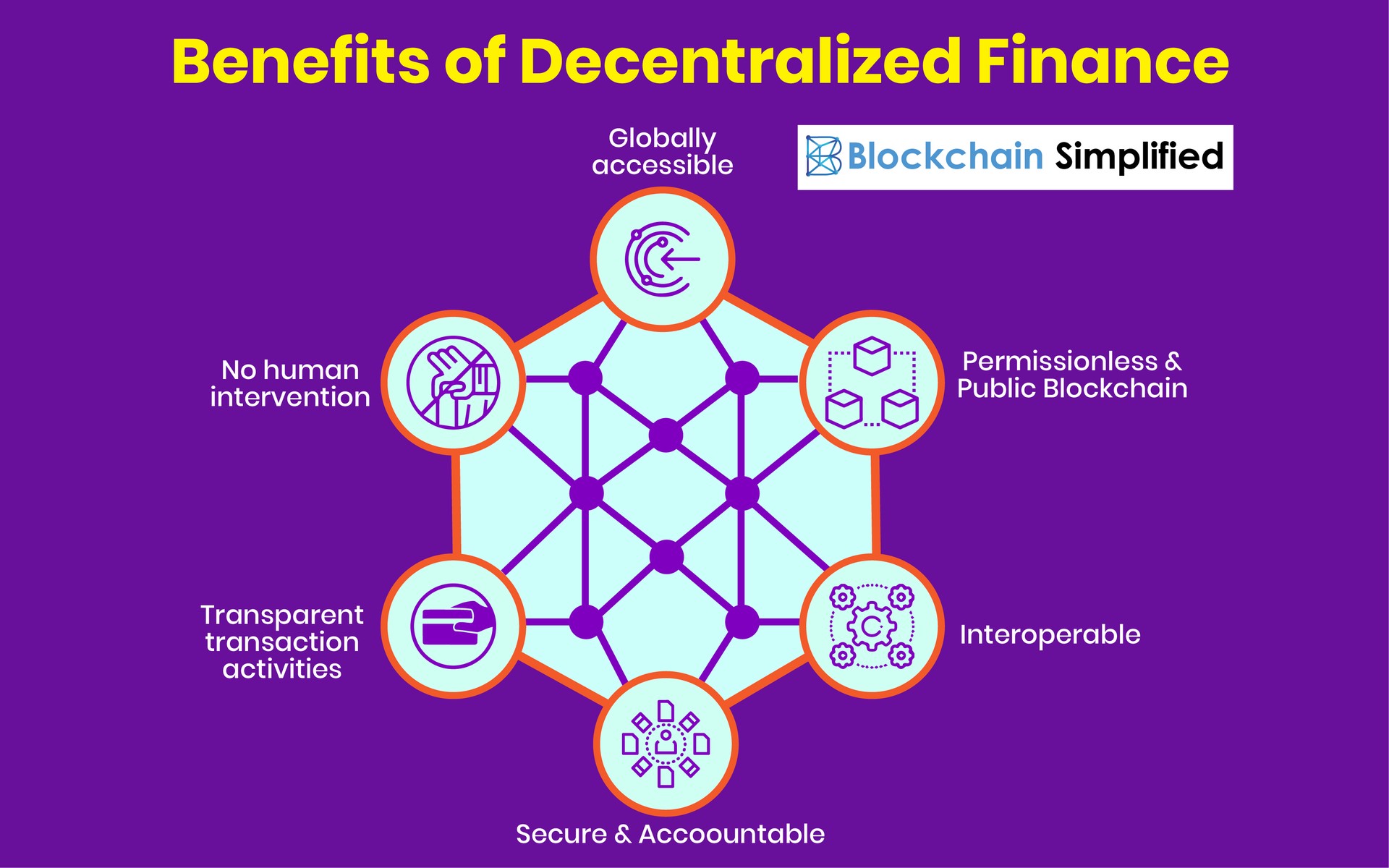

Uniswap ‘s the globe’s prominent decentralized exchange by regularity replaced. They allow it to be users to help you trade cryptocurrencies instead of a main third party. Uniswap features its own blockchain that is hosted to your Ethereum platform, and since for the, Uniswap simply allows ERC-20 tokens. Central exchanges try controlled by a singular category otherwise organization, for example an openly exchanged company otherwise private team. Decentralized transfers (DEXs) are controlled by tech protocols that enable high groups of people to efficiently generate decisions and go opinion. Decentralized crypto transfers are a software of decentralized financing (DeFi).

Make sure the website try genuine and you will recognize how DEXs functions ahead of giving any purchase. Theoretically, extremely exchanges on the one DEX takes lay close-instantly for individuals who pay the correct miner’s commission and set trading standards truthfully. For one, we’d strongly recommend you listed below are some a good DEX aggregator such as 1inch, that may give you use of an array of most other DEXs and you may communities. After you’ve familiarised oneself with these people, you can choose to visit on the DEX you like. Another essential benefit of using a great DEX is that no private info is ever before necessary from you (if you don’t fool around with a charge card otherwise bank to shop for crypto using them). Having fun with a DEX is a sure way you could potentially retain power more your own crypto and you can shell out stick to on the “maybe not the keys, perhaps not the crypto” mantra.

- Bancor is actually one of the primary AMMs to arise to your Ethereum straight back inside 2017.

- Although not, deploying tokens myself will likely be high-risk, because the noticed in the newest Ross Ulbricht wallet mishap, in which a misconfigured exchangeability configurations triggered $several million inside the losings.

- By incorporating that it timestamping procedure, the new blockchain means prevents to the main strings are set up in the an excellent chronological purchase, highlighting the fresh sequential buy from purchases.

- Sincere attackers embrace a more elaborate means compared to the almost every other crooks, while they lack expertise in the state of for each cut off.

- Profiles need instead convert their ETH in order to “Wrapped Ether” (WETH) that’s equal in cost in order to ETH for them to exchange.

Choosing the right DEX crypto change can seem overwhelming, nevertheless doesn’t have to be. Are you seeking the finest Bitcoin exchange platform or one which supports a multitude of cryptocurrencies? Find decentralized crypto transfers that provide strong defense, user-amicable connects, and you can reputable support service. A good mixture of these features will assist you to discover better system for your change standards. The newest dictionary attack comprises a variety of brute-push attack employed to illicitly availability private information otherwise possibilities, in addition to passwords, hashes, digital signatures, and you can encoding formulas.

The brand new exchangeability pond is highly well-known among DeFi investors with a good importance of effective portfolio management. Balancer lets profiles to earn costs if you are however rebalancing their profiles. An educated DEX crypto exchanges will likely be easy to use, despite where you are or device.

Inside the a DEX, users hold control over their personal keys meaning that its assets, carrying out transactions straight from its private purses. That it model advances defense because the change alone does not keep affiliate money, decreasing the chance of hacks and you will theft. However, CEXs capture infant custody from affiliate money, carrying them inside company-controlled wallets. Although this can also be make clear trading and supply a lot more functions including recuperation from lost passwords, it also introduces threats in case your exchange’s security is actually jeopardized. The brand new architecture of an excellent DEX try underpinned by blockchain tech, particularly playing with smart agreements to execute positions automatically and you may safely instead of person input. Such exchanges support many cryptocurrencies and you will tokens, taking investors which have many change sets.

A great DEX aggregator chooses an educated and also the most affordable costs among decentralized transfers to help its people to stick to the best-valued change. When a user desires to trade you to for another, they post the property so you can a smart package. The newest smart bargain next fits trade requests and you can does the brand new exchange instantly if the criteria are fulfilled, the while maintaining infant custody of the property inside the users’ wallets. Centralized exchanges routinely have high exchange quantities than simply DEXs—an attribute you to definitely grows exchange exchangeability and you may decreases concentration risk. Whether should it be you’re right here to understand more about the newest platforms aside out of interest otherwise looking out since the an aspiring business person, this web site will help you.

For this reason, you’re also more likely to easily and as opposed to price impression pick otherwise promote a good cryptocurrency on the a transfer with high liquidity than just for the an exchange that have reduced exchangeability. Large liquidity will also help people to get an excellent charges for their positions. Because the crypto DEX market develops, the newest proliferation of the latest protocols and you will support components might simply speeds. This try a sign of the brand new persisted gains and you may growth of your own DeFi community. Inside October 2021, DEXs canned nearly $90 billion USD in the trading frequency, to the combined volume of Uniswap and SushiSwap are responsible for more 80% of the matter.

Community-wise, the new change qualifies since the a great decentralized autonomous company (DAO), having $ORCA token holders deciding proposals as well as the company’s coming. Token people in addition to decide the newest DAO council, and that contributes another covering from decentralization to the change. In the future, holders out of MEXC’s native $MX token are certain to get unique benefits across the entire ecosystem, such as the DEX and you may P2P marketplaces. And you can such as OKX, Byreal tools MEV protection for everybody investments to make sure fair rates.

Decentralized transfers usually are reduced and more successful than simply old-fashioned transfers. They don’t want profiles to attend to own an authorized so you can make certain transactions. Automated Market Creator (AMM) DEXs for example Uniswap and SushiSwap facilitate investments because of liquidity swimming pools, deciding costs algorithmically according to have and demand. There may not an overall total greatest change, because the per features its own power and you can tiredness.

Comments are closed.